Entrepreneurial Spirit, Engineering Drive, Local Flavor

Our Story

9 Dots Inc. stands at the forefront of modern mining, combining cutting-edge technology with sustainable practices. Our commitment to excellence, safety, and environmental responsibility sets us apart in the industry.

Founded in

2017

Employees

49

Total Area

37km2

Meters DRilled

20,000+

9 Dots Timeline

2025

9 Dots Inc mined and processed more than 100,000 tons in 2025.

We processed on average 1,990 tons of ore per week and thanks to the team we had very stable operations. Our 2025 AISC was $852.61/oz.

In addition to minimal but stable sales throughout the year, in Nov 2025 we signed our first off-take agreement and are set to begin deliveries in March 2026.

We hope to continue delivering great results in 2026 and beyond.

2024

El Rubi & Santo Nino Drill Program

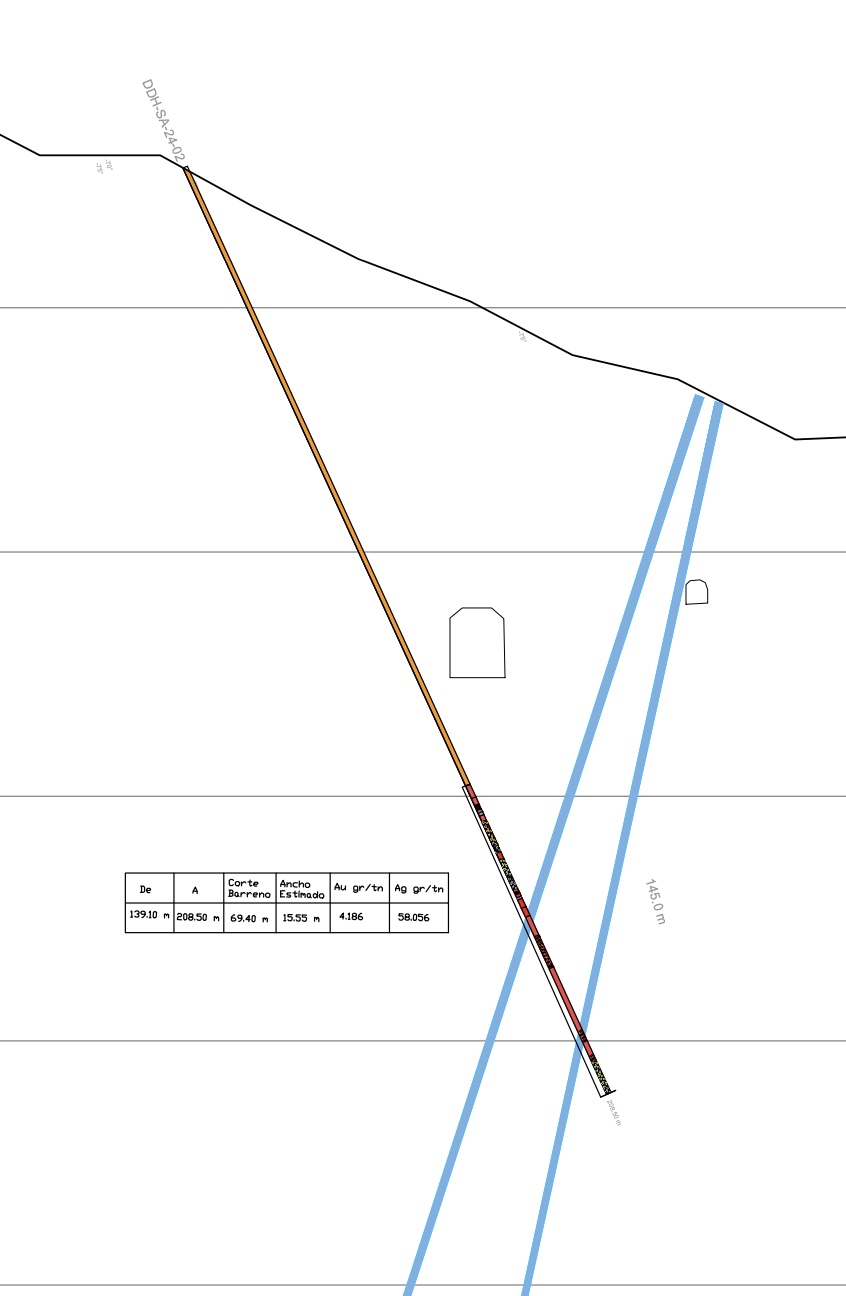

In the mine areas, direct exploration activities with diamond drilling were initiated by the company Operaciones Industriales y Servicios Especializados del Pacifico, supported by the drilling company Amapa Drilling, during the months of August to November 2024.

In Phase 1, a total of 5,540 meters were drilled. Within that El Rubi totaled 4,165m across 30 drill holes, and Santo Nino totaled 1,375m across 8 drill holes.

In Phase 2, a total of 7,162 meters were drilled. Within that El Rubi totaled 6,077m across 22 drill holes, and Santo Nino totaled 1,085m across 4 drill holes.

Within this program we drilled our the best hole to date at the mine.

The values were:

El Rubi – 5.72 g/t Au, 60.815 g/t Ag over 69.4 meters

within that 23.888 g/t Au, 101.970 g/t Ag over 7.1m at 147m depth.

Although we are still processing the cores,

some other notable values are:

0.837 g/t Au, 34.402 g/t Ag over 39.9 meters at 7 meters depth..

0.651 g/t Au, 43.642 g/t Ag over 44.6 meters at 73m depth.

2023-2024

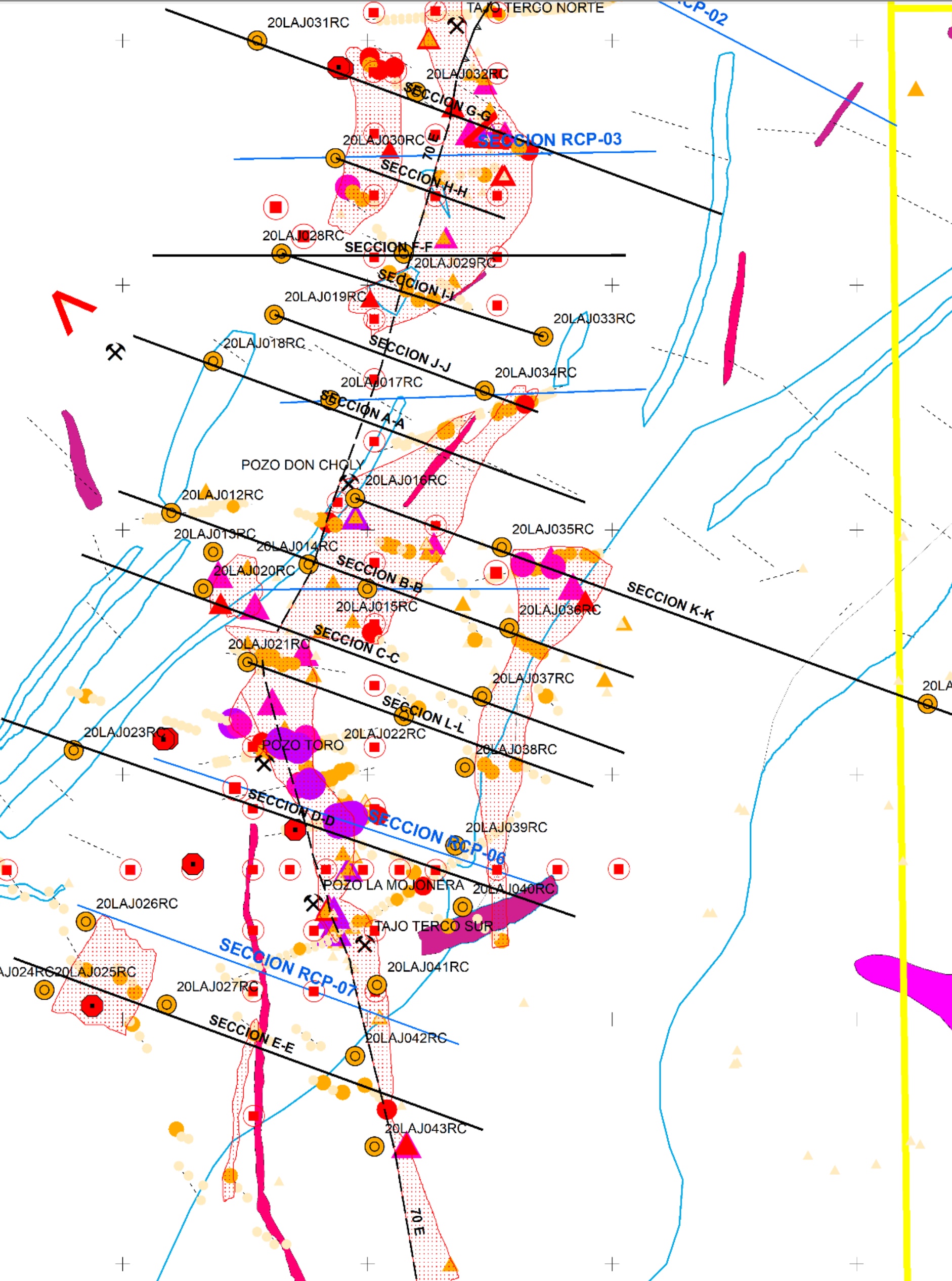

San Pedro Drill Program

9 Dots Inc commenced the in March 2024 in conjunction direct exploration activities were undertaken by SILSA Advanced Engineering S.A. de C.V.

During this program a total of 4,152 meters was drilled across 86 bore holes all within the San Pedro area.

Notable values were

1.86 g/t Au over 12 meters at 12m depth

1.73 g/t Au over 10 meters at 16m depth

1.68 g/t Au over 8 meters at 16m depth

0.7 g/t Au over 48 meters including 3m at 6.3 g/t Au at 16m depth.

0.43 g/t Au over 24 meters including at 30m depth.

2023

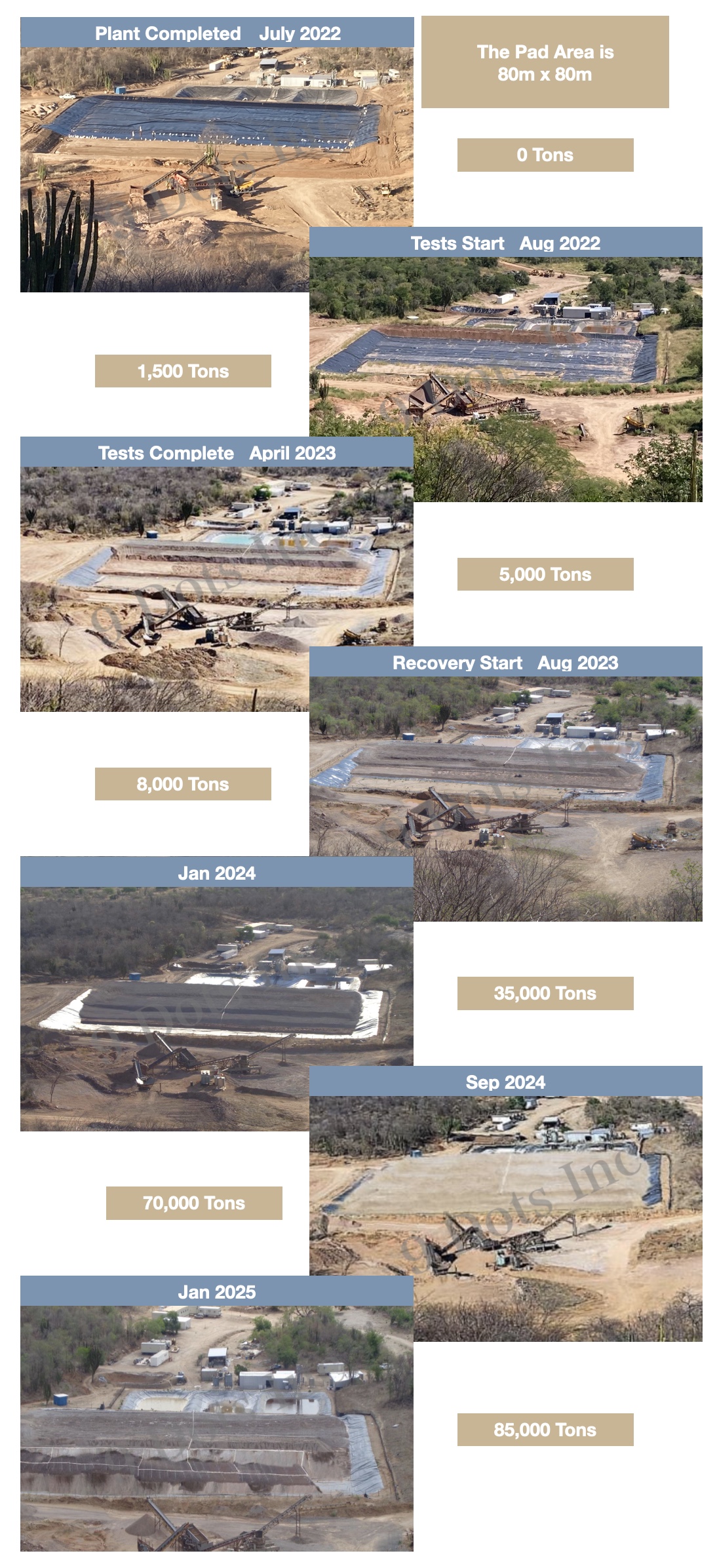

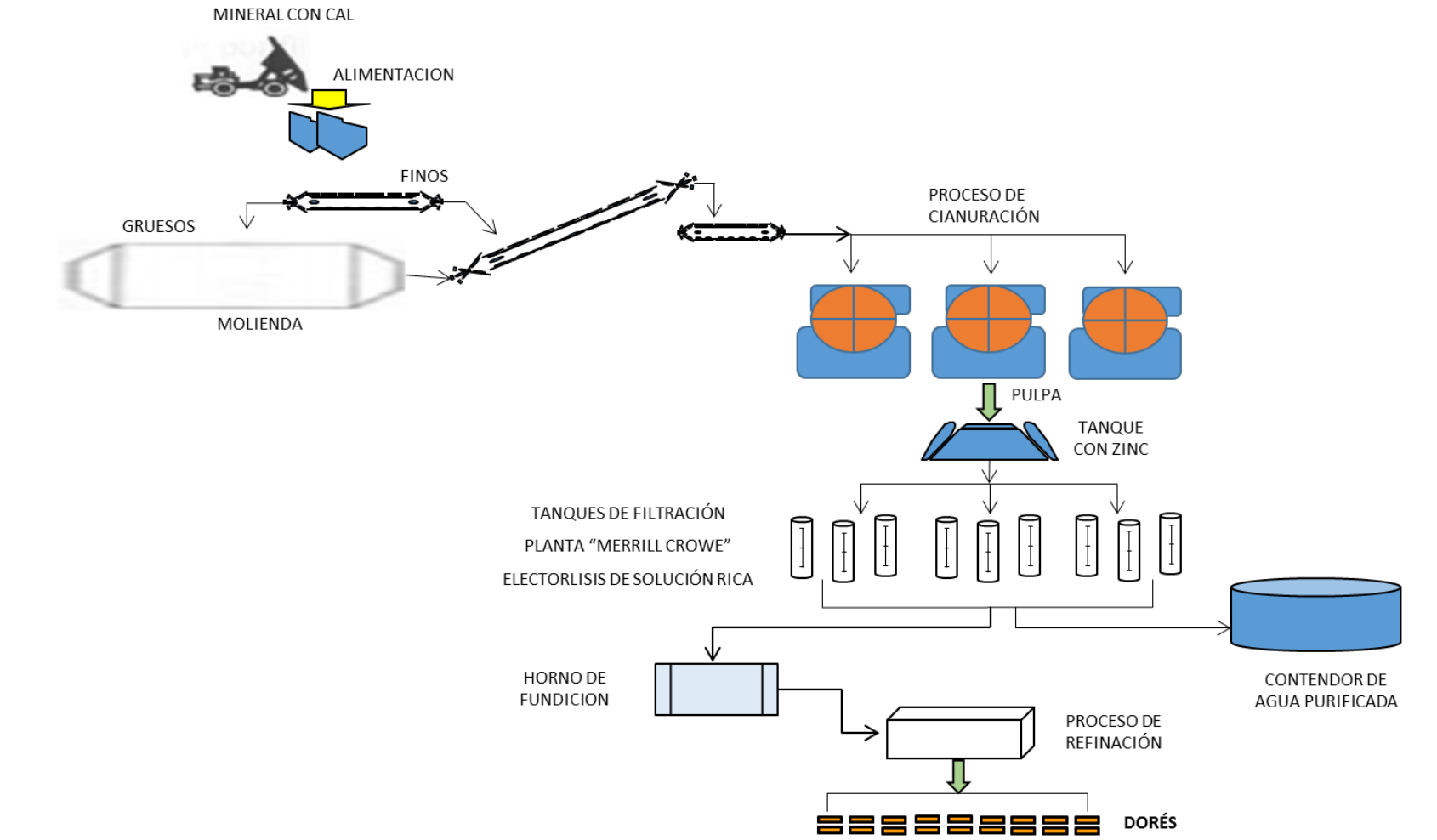

The commercial scale heap leeching plant (stage 4) facility was completed in Sep 2022 in the Santo Nino area and after a 6 month test program became operational in March 2023.

2022-2024

Visibile in the video above, the commercial scale heap leeching plant (stage 4) facility was completed in Sep 2022 in the Santo Nino area and after a 6 month test program became operational in March 2023.

The initial capacity of the crushing system was spec’d to 5,000 tons per week but budget constraints kept our initial progress slow and we have gradually increased it, arriving at an average of 1,640 tons per week in 2024.

In June 2024 we began the process of leeching the pad and have been doing so continuously ever since.

2022-2024

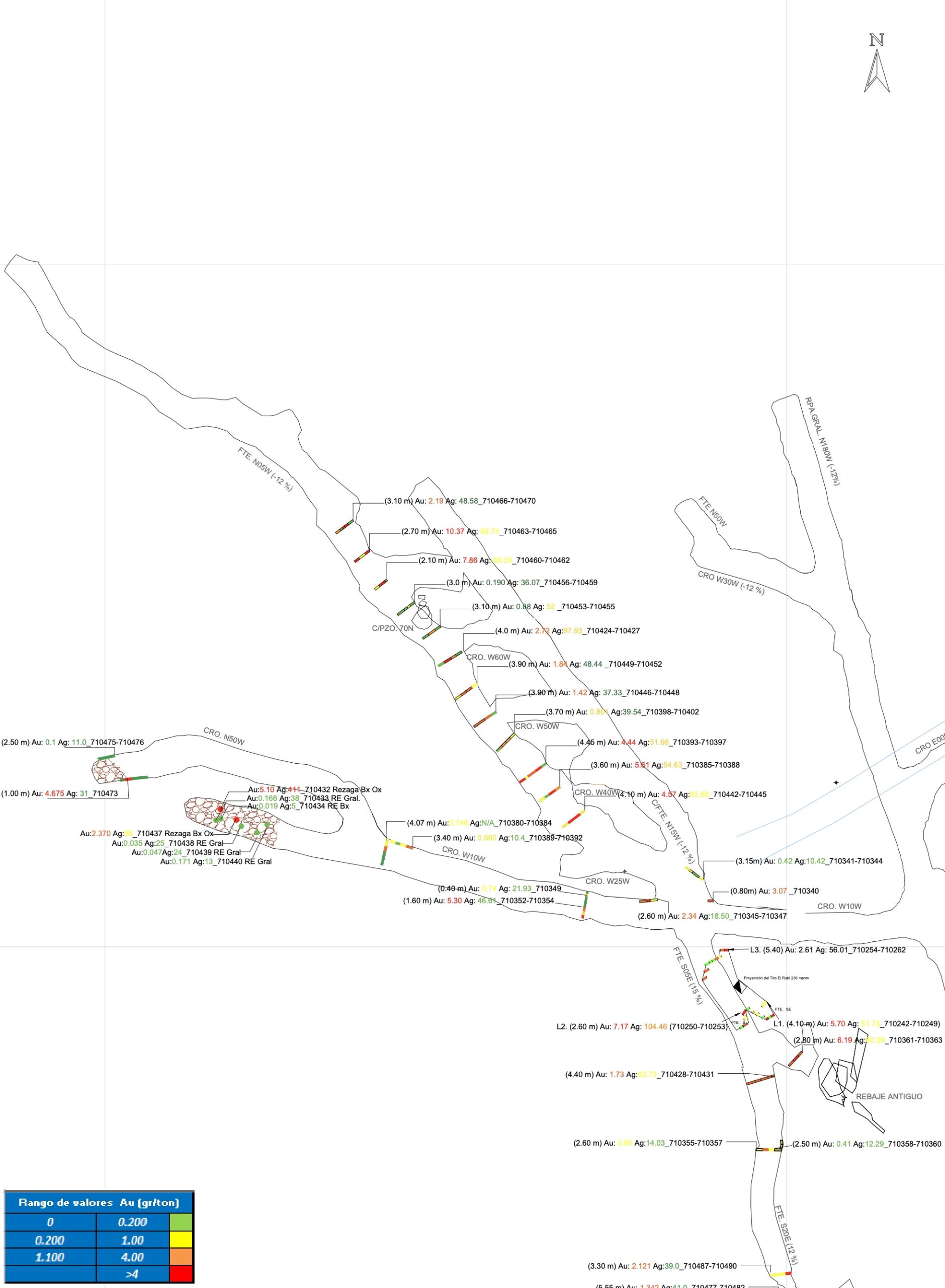

During the buildout to stage3/4, 9 Dots Inc was faced with the covid shutdowns that led to significant equipment procurement delays. Instead of letting the budget go to waste, a decision was made to open a tunnel into El Rubi manually as a passive project. Now some 1.5km have been excavated at a height of 3.5m and width of 5m.

The major takeaway from this was the study of the ore vein at depth. Specifically at 50m depth along the path of the major vein we found:

3.358 g/t Au, 58.18 g/t Ag over 41.65m

(Includes 8, 11, and 10.37 g/t other below)

This program led to 9 of the top 11 highest silver intercepts to date

1) 5.1 g/t Au, 411 g/t Ag Rezaga Bx Ox

2) 21.793 g/t Au, 250g/t Ag over 0.8m

*3) 150 g/t Ag taken in 2004 by SRC at El Rubi

*4) 114.8 g/t Ag taken in 1975 at by SGM at San Carlos

5) 7.17g/t Au, 104.46g/t Ag over 2.6m (includes #2)

6) 2.2 g/t Au, 97.93 g/t Ag over 4.0m

7) 40.02 g/t Au, 90 g/t Ag over 0.6m

8) 7.86 g/t Au, 88.24 g/t Ag over 2.1m

9) 2.37g g/t Au, 88 g/t Ag Rezaga Bx Ox

10) 14.05 g/t Au, 85 g/t Ag over 0.6m

11) 4.57 g/t Au, 82.68 g/t Ag over 4.1m

Other significant intersects were:

13.45 g/t Au, 36.30 g/t Ag over 4.6m

10.37 g/t Au, 66.74 g/t Ag over 2.7m

(The underground tunnels can be seen in the 2023 video above)

2020-2021

During 9 Dots Inc’s 6 month pilot program (stage 2) which ran from August 2020 to March 2021. A total of 910 batches were leeched with an average recovery rate of 92.2%. A total of 95.7 oz Au and 699.5 oz Ag were produced. While an initial infusion of capital was necessary the pilot program itself was self-sustaining during the 6 month duration.

Using this knowledge foundation as a base, a decision was made to move on to the next phase and begin to scale the mine development.

Initially 9 Dots Inc. planned a medium scale bath leeching plant (stage 3) with the ramp beginning in March 2021. However due to Covid there were significant delays in delivery times for the crushing systems and other necessary equipment that led to the project being pushed back by 9 months negatively impacting our budget.

At this point in time an executive decision was made to go directly to a commercial scale heap leeching plant. (stage 4)

2020

Covid

2019-2020

After a 6 month transionary period 9 Dots Inc was formally named managing partner in August 2019 and was retained for its technical and financial expertise.

Over the course of 3 months 9 Dots created a mine development plan utilizing modern mining methods, combining cutting-edge technology with sustainable practices. The initial project plan called for a 4 stage ramp up and was finalized in November 2019.

The initial phases of the ramp (stage 1) focused on developing the technology to extract gold and silver from the 270,000 tons of tailings produced between 1902-1942. These tailings present a unique chance to develop expertise in leeching the ores present in the La Sabina mine without actual excavation or crushing.

During this ramp the extraction was carried out utilizing a dynamic leeching process in an agitation tank to quickly and efficiently recover gold and silver while keeping development costs to a minimum.

Having taken over a struggling project there were many engineering challenges that needed to be overcome and 9 Dots Inc. took major steps to eliminate single points of failure while also adding modularity to the extraction facility before beginning the subsequent 6 month pilot program (stage 2) in July 2020.

2016-2018

Silveyra S.A. de C.V (SILSA) together with Green Design S.A. de C.V. and La Paz International Trading S.A. de C.V. (GDLP) set about rehabilitating the mine on the ruins of the 1902-1942 SFM operations.

GDLP developing the base infrastructure to support the mine. GDLP had deep financial ties to Japan and began soliciting investors in Japan to support the project. In Dec 2016 they secured their first investment

However the project scope was much longer than expected, and there were delays in dealing with the government when trying to reconnect electricity to the dilapidated mine site.

Design flaws also did not fully take into account things like electrical supply despite the mechanical and technical accuracy and led to major cost over runs. This led to issues in scaling that were in conflict with the real world complexities that existed on the ground in Mexico.

GDLP was able to recover a very minimal amount of gold and silver utilizing an agitation tank but was unable to scale the project and passed off the project to 9 Dots Inc. in early 2019.

2015-2016

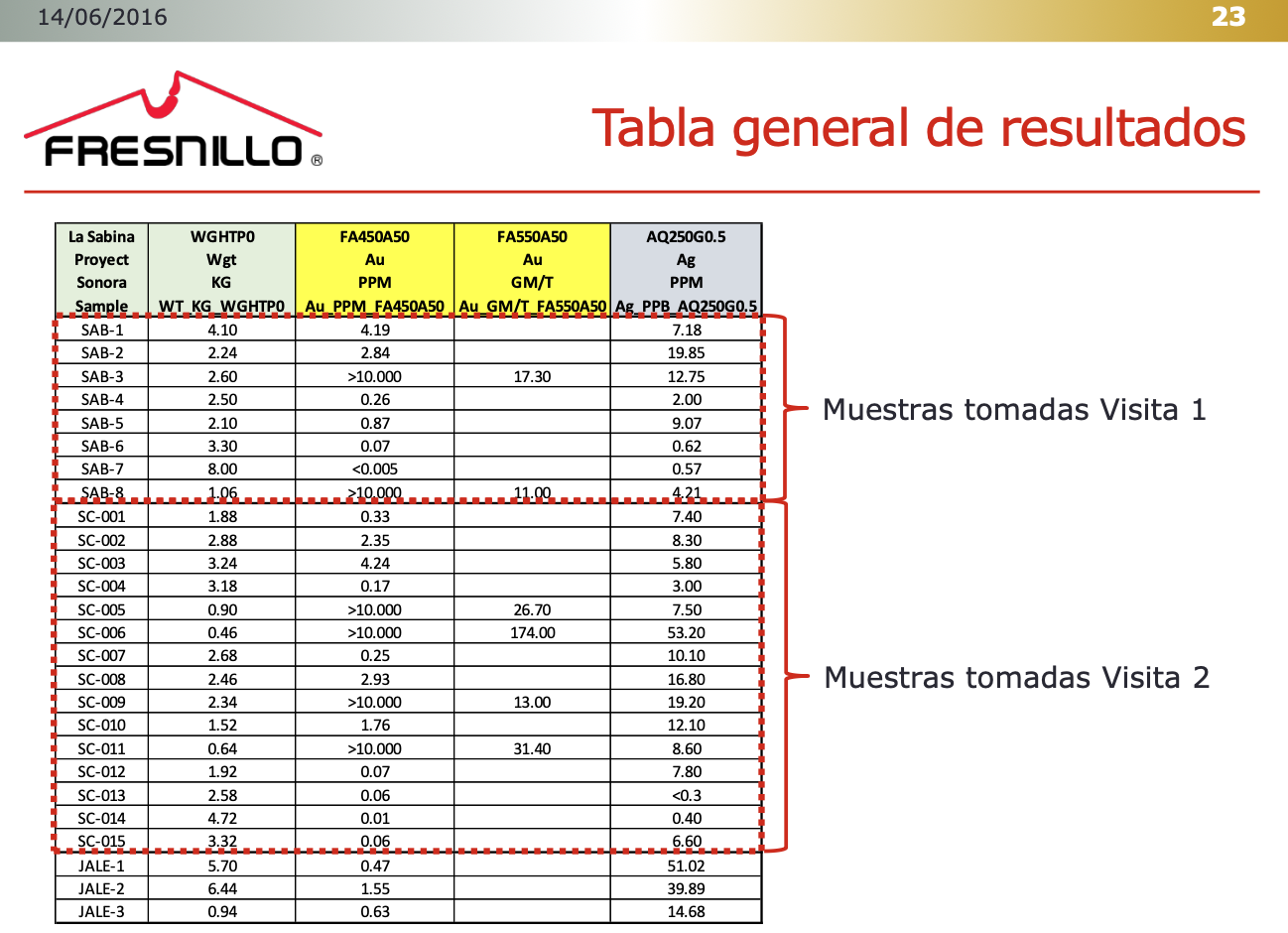

The UK listed Mexican Silver Major Fresnillo PLC commenced a reconnaissance program in 2016 when it was looking to strengthen its domestic precious metals position.

More than 916 km2 was surveyed in the southern Sonora area and La Sabina who had recently completed its Environmental Impact Survey (MIA) was included in the program.

Although sparse evidence could be identified, the data of the full drilling program undertaken by Placer Dome (1996) and SRC (2005) were not readily available as they were not possessed by SILSA and as such, the mine could not adequately explored by Fresnillo PLC.

Due to this lack of information Frensillo only focused on the San Carlos area of the mine during their initial site visit in Nov 2015. Still, the results were good enough to warrant a second site visit in Jan 2016 where they found the highest grade sample in the history of the mine.

The values were:

SC-006: 174 g/t Au, 53.2 g/t Ag, 1,240 g/t Cu, 4,120 g/t Pb 5,590 g/t Zn over 0.1 meters.

Nov 2015 visit notable findings:

SAB-3 – 17.8 g/t Au, 12.75 g/t Ag over 1.0 meters.

SAB-8 – 13.57 g/t Au, 4.21 g/t Ag over 1.0 meters.

Jan 2016 visit notable findings:

SC-005: 26.7 g/t Au, 7.5 g/t Ag, 500 g/t Cu, 1,310 g/t Pb, 3,060 g/t Zn over 0.15 meters.

SC-011: 31.4 g/t Au, 8.6 g/t Ag, 250 g/t Cu, 1,680 g/t Pb, 3,750 g/t Zn over 0.15 meters.

2007-2015

Silveyra S.A. de C.V (SILSA) was a construction company and equipment and operator subcontractor that took over the project in 2007. The mine was one of many projects to them, to be developed over time. Here SILSA took on the challenge of stepping up from subcontractor to primary operator.

However due to a lack of handoff of information from the previous company progress was slow and difficult. Despite that through exploration and ongoing conversations with the claim owner SILSA developed and understanding of the mine which culminated in a 2014 report that contained an operational plan for the mine.

It was here that first see their idea to utilize the 270,000 tons of tailings leftover from the 1902-1942 SFM operations as a crutch to lower initial CapEx, to provide much needed income in the initial stages of the mine and to serve as a proof of concept for extraction techniques suited for the ore at the mine.

SILSA was able to plan the technical and operational aspects of the mine but ran into roadblocks when trying to plan the metallurgical components of the mine. Despite understanding what needed to be done, they lacked the core competencies and the budget necessary to develop the technology required for ongoing extraction of gold and silver from the ores.

Their 2014 Plan thus culminated in them looking for an investor to bring in capital and fund the research necessary to operate the mine.

SILSA entered into an agreement with Green Design S.A. de C.V. and La Paz International Trading S.A. de C.V. (GDLP) in late 2015. These companies together were a junior exploration company looking to develop a project in Sonora. GDLP entered into an agreement to develop and operate the mining plan established by SILSA in 2014.

In 2015 GDLP secured their first investment and they immediately set about getting the mine permitted and completed the Environmental Impact Survey (MIA) in Nov 2015.

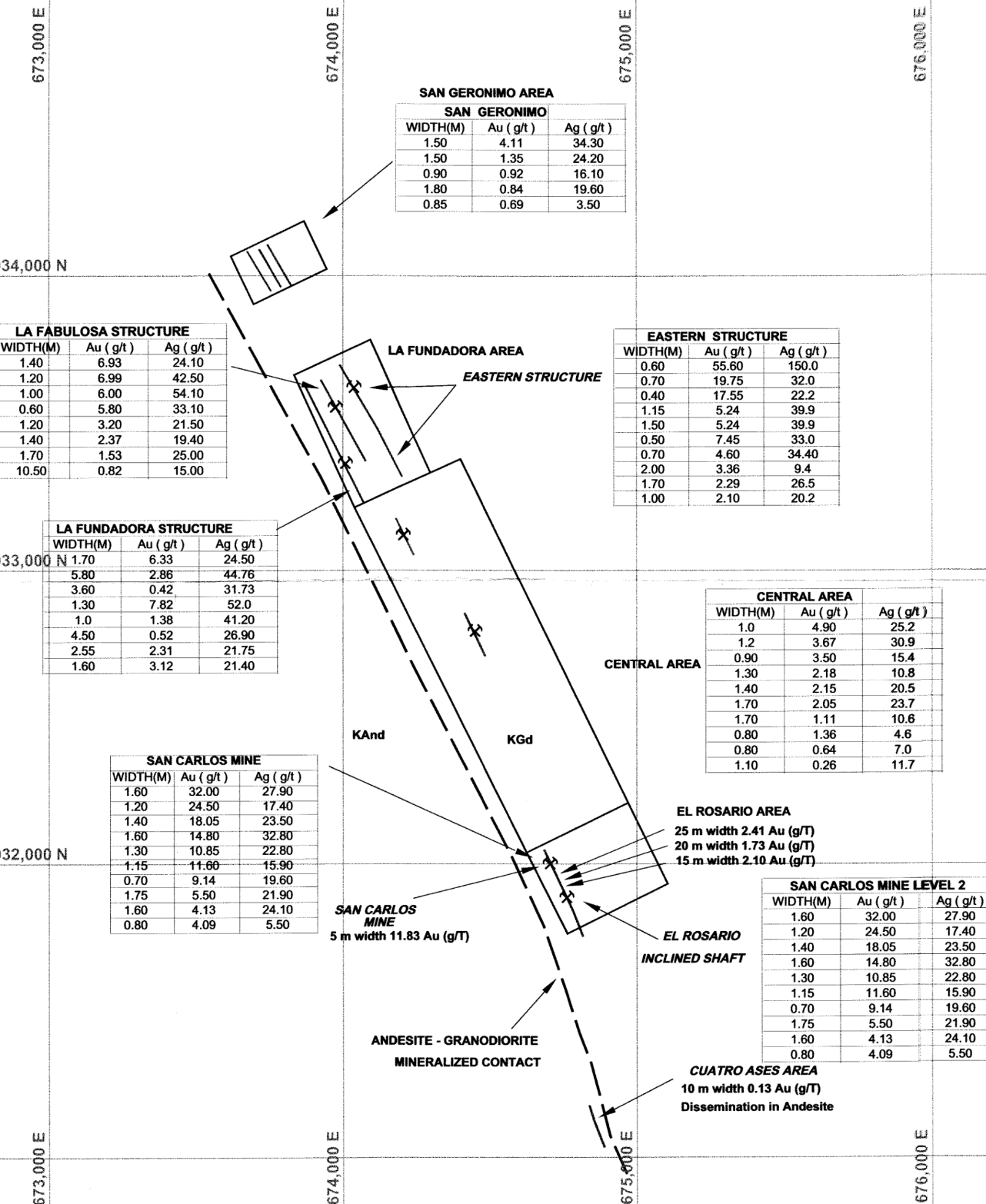

2004-2007

The mine was acquired by Minera La Golodrina S. de R. L. de C.V. (subsidiary of Treasure Resources) who drilled 9 bore holes totaling 1660.45m in 2005 and had a third-party Due Diligence Report commissioned during purchase that was outsourced to Sydney Resource Corporation. (SRC)

This document was procured in 2024 from one of the SRC geologists met by 9 Dots Inc during the initialization of their drill program. However due to the lack of a handoff to SILSA this data remained unavailable/inaccessible during 2007-2024 as a result.

SRC spent 42 days on the site in 2004 and over 6 months produced a thorough 66 page report detailing their findings. This report also includes substantial internal information from Placer Dome and direct interviews of previous operators such as Mr. Graff (1955).

In addition to full geological data and mapping, 435 channel samples were collected and processed. 386 samples had more than 0.01g Au, 200 more than 0.1 g/t Au, 100 more than 1 g/t Au and 47 more than 3g/t Au the highest single samples being:

San Carlos – 32 g/t Au, 27.9 g/t Ag, 497.0 g/t Cu, 3,170 g/t Pb 5,530 g/t Zn over 1.6 meters.

El Rubi – 55.6 g/t Au, 150 g/t Ag, 655 g/t Cu, 1505 g/t Pb, 4,330 g/t Zn over 0.6 meters.

SRC’s independent report concluded that the potential of the prospect can estimated at 400,000 to 700,000 oz Au. Specifically the south block San Carlos and north block El Rubi together have the potential of some 560,000 oz Au with higher potential dependent on the exploration of the central areas.

The company abandoned the project in 2008 due to infighting when the gold price crashed over 30% during the year and the project was picked up by Silveyra S.A. de C.V.

1995-2004

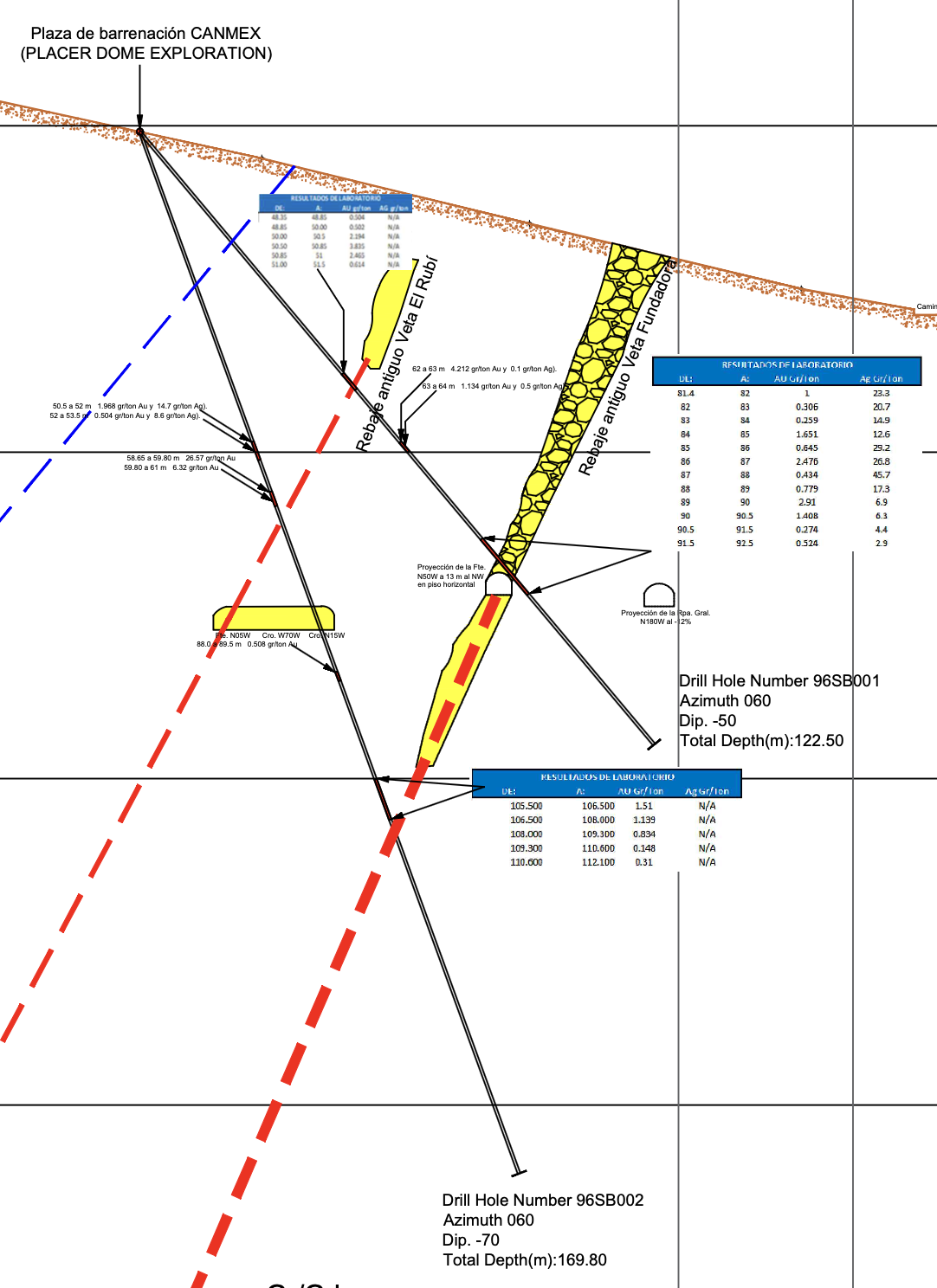

Modern Exploration began in 1995 when the company Canmex S.A. de C.V. (a subsidiary of Placer Dome) carried out an exploration program.

Their program comprised of 13 diamond HQ diameter bore holes totaling 1,457.4m and 22 trenches some up to 180 meters long.

The highest results were in Dec. 1996 from the San Pedro area with results of 134 g/t Au, 0.8 g/t Ag over 1.64 meters at a depth of 100m.

Other notable drill results were

San Pedro – 22.23 g/t Au, 3.8 g/t Ag over 3.0m at 112.5m depth

El Rubi – 16.23 g/t Au, 17.826 g/t Ag over 2.35m at 58.6m depth

San Carlos – 3.15 g/t Au and 15 g/t Ag over 12.7m

San Carlos – 11.83 g/t Au, 17.55 g/t Ag over 5m

Notable trench results yielded

San Carlos – 2.41g/t Au 23.9 g/t Ag over 25m

El Rubi – 1.31 g/t Au over 30 meters

El Rubi – 0.8 g/t Au over 27 meters

San Pedro – 0.48 g/t Au over 81 meters

San Pedro – 0.98 g/t Au over 41 meters

Placer Dome abandoned the project in 1997 because their initial findings did not indicate an ore body of more than 2,000,000 oz Au.

The mine was spun off to Minera La Golodrina, S. de R. L. de C.V. (subsidiary of Treasure Resources) just prior to the US$9.2 Billion acquisition of Placer Dome by Barrick Gold Corporation which completed in Jan 2006 and was one the largest transactions in the history of the mining industry at that point in time.

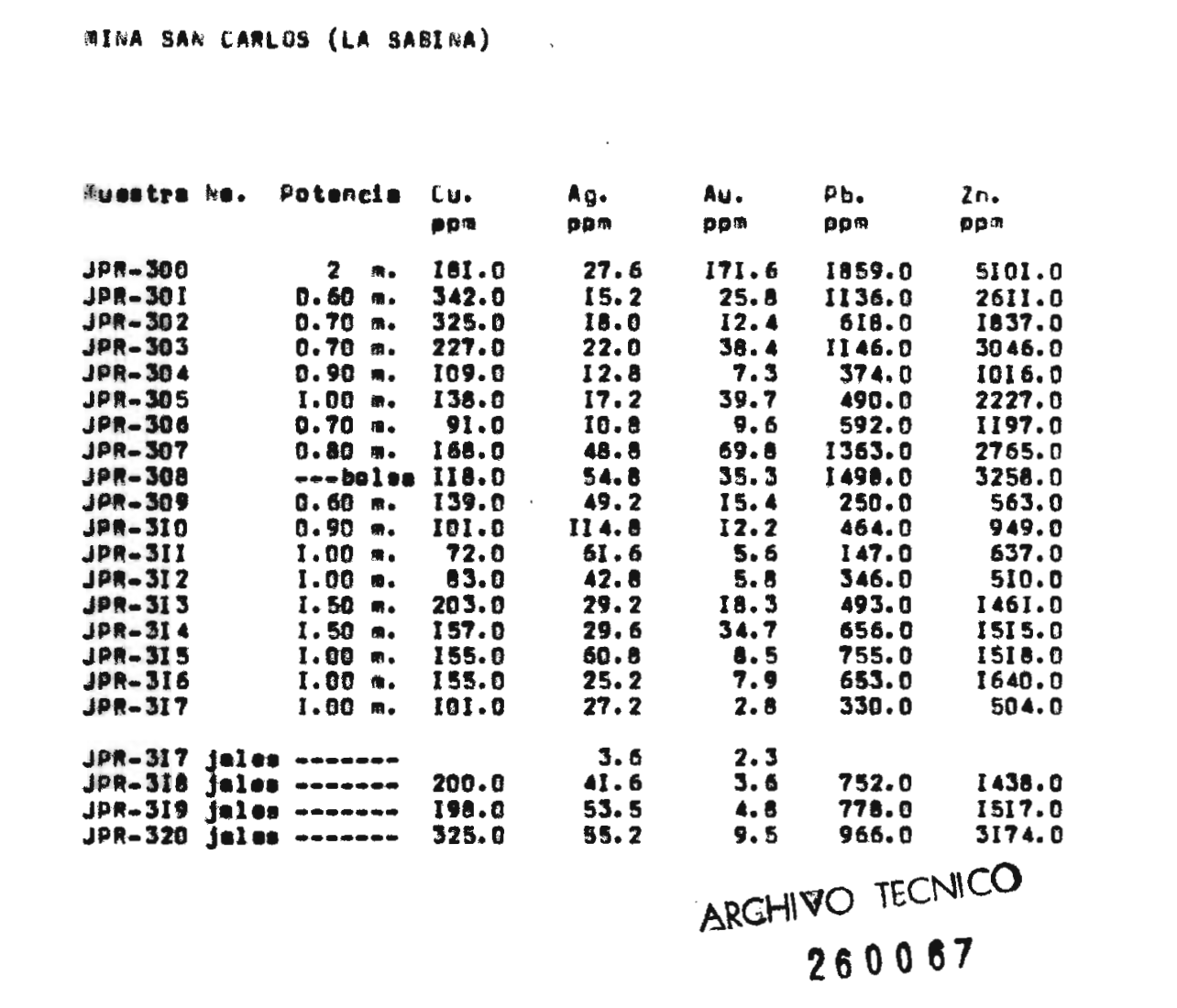

1975

The mine shows up in a 12 page report from the technical archives of the Geological Service of Mexico (SGM). (260067)

This report goes into detail about the geography, the climate, the economy, the culture, and the physiography of the surrounding area, as well as the geology and tectonics of the mine.

During their study of the La Sabina mine the SGM primarily explored the San Carlos level 2 zone and the tailings left by SFM. Numerous high grade samples were taken, the highest single sample being:

171.6 g/t Au, 27.6 g/t Ag, 181.0 g/t Cu, 1,859 g/t Pb 5,101 g/t Zn over 2 meters.

At the time, this single sample was the highest grade result in working history of the mine. These records dated to August 1975 also detail how SGM may have removed some 4,000 tons of ore with grades averaging 30 g/t Au

1955 – 1975

In 1955, there was an attempt at exploitation promoted by the German miner Mr. Julio Graff (son of the SFM assayist) who focused in the El Rubi area. This effort produced a maximum of 600 Oz Au per month, and continued all the way until the late 1970’s where it was still producing some 200+ Oz Au and 933+ Oz Ag per month.

Mr. Graff said in 2006 that they were running an exploration crosscut in level six to the west of the main mineralized zone of El Rubi when they discovered a quartz-black calcite vein, which they called “Veta Prieta” (very black vein). This vein is not seen on the surface.

In the cross cut the width of the Veta Prieta is more than 10m with 3 g/t Au and 900 g/t Ag. They did not mine this vein due to the low gold content and low silver price at the time.

Mr Graff also commented that in the San Pedro zone, they were taking out “rezagas” (broken ore / un-mucked rock) with gold content of 95 to 100 g/t Au. However they were forced to stop due to having problems with the people of the “Cooperative Minera La Sabina” who were the owners of the mine.

1888 – 1942

The San Francisco Mining Co. (SFM) having acquired the mine in 1888, prepared the mine and built a dynamic cyanide leeching plant that began operations in 1902 at a rate of 60 TPD.

These operations however were suspended from 1910-1917 during the Mexican Revolution. Stable operations resumed and continued until 1938. Unionism triumphed and the mine ended up being controlled by the “Cooperative Minera La Sabina” that led to the failure of the mine by 1942.

In this period 1902-1938 SFM exploited the northern portion of the mine near El Rubi in a sector of 400 meters in length on three parallel sub veins separated by 15 to 20 meters up to a depth of 90 meters. The mine was built to 6 levels deep with each level consisting of 15m of depth.

It is estimated that these mines produced over 700,000 tons with grades of 20g/t Au. Deposits of some 270,000 tons of milled ore tailings ground into a powder (sales) on the site suggest that production at this time may have been about 1.5 MT of ore or about 300,000 oz Au or more. Even now they contain 1-2+ g/t Au.

1873 – 1888

At the end of the 19th century the mine ended up under control of Carlos Conant Maldonado, the Mexican businessman, colonel, and politician.

He was a shareholder and superintendent of the Santa Juliana Mining Company.

After a severe strike of miners in 1883 during which multiple people lost their lives, the company and his shares were sold in 1888 to the San Francisco Mining Co. (SFM)

He was a leader of the settlers in southern Sonora, known the pioneer of the Yaqui Valley and the pioneer of irrigated agriculture in southern Sonora. In 1890 he founded the Sonora-Sinaloa Irrigation Company which led the first project to survey, irrigate, divide, and prepare some 300,000 hectares of land in the Yaqui Valley.

He was enshrined in the region’s history in Nov 1984 when a statue of him referred to as the Monument of the Pioneers was erected at Pioneers Park in Ciudad Obregón.

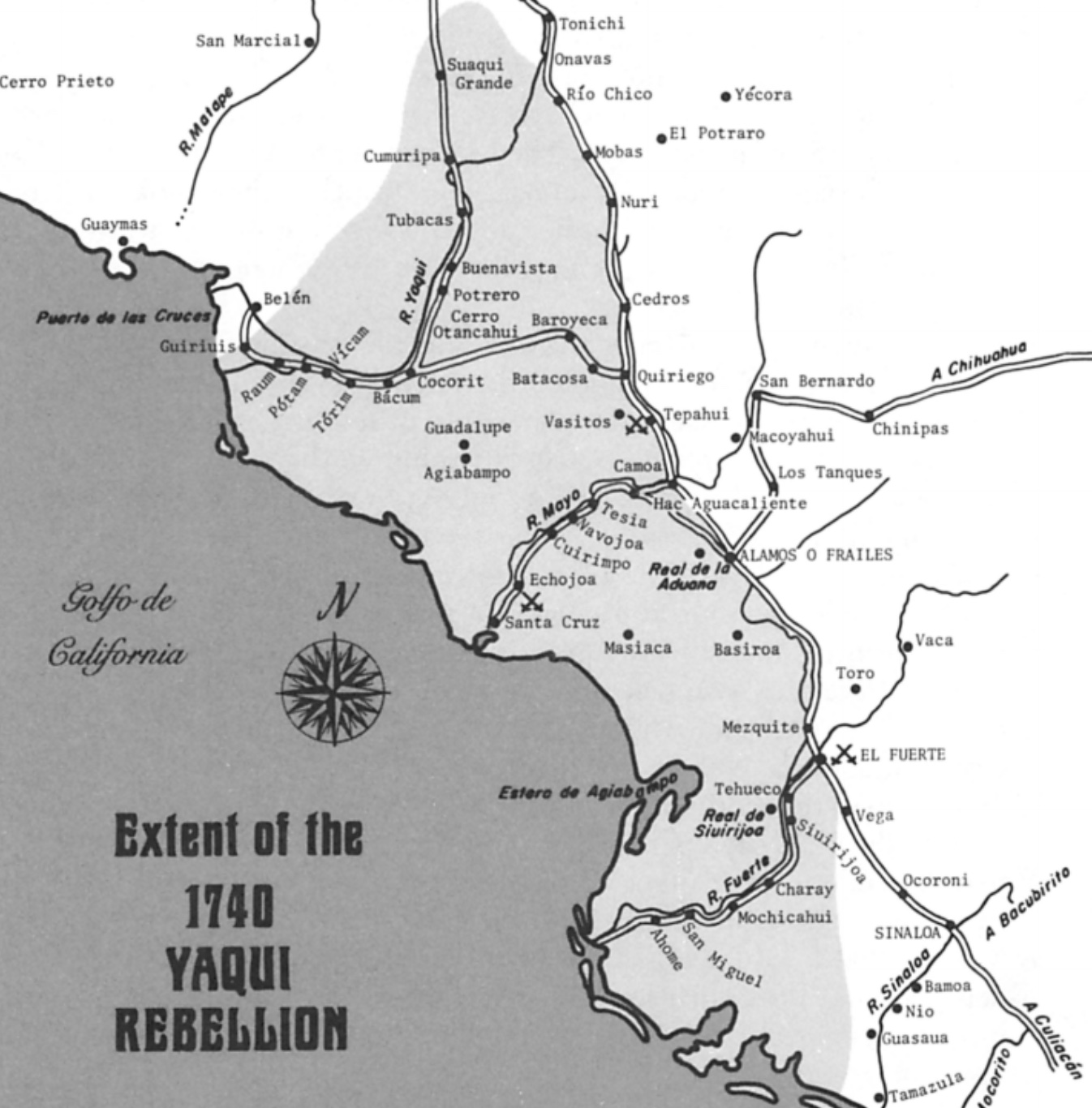

1627 – 1740

Long after the establishment of the Tepahui Mission in 1627, in 1735 the jesuit priest vecino Don Andres de Quiroz was known to have coveted a pice of land (a mine) in the Tepahui mission, adjacent to the Yaqui.

This location of the first conflict is exactly where our mine is located.

The Yaqui Indians resisted his attempted encroachment “because they did not want Spaniards to live among them.”

A dispute arose and Quiroz was deterred from pressing his claims by three fathers of the faith and settled for a “just and friendly resolution”

But when Governor Huidobro appointed Don Andres’s brother, Don Miguel, as alcalde mayor of Ostimuri, the missionaries interpreted the act as retaliation for the intervention in the Tepahui dispute.

According to them, the two Quiroz brothers “liberally offered Indian land to Spaniards,” causing enormous pain that began to plunge the Indians “into desperation.”

It was this Spanish usurpation of Indian land that led to the outbreak of rebellion, ‘The Yaqui Rebillion’ in 1740, the fathers concluded in an authoritative tone that suggested no further discussion necessary.

1617-1627

The Jesuits arrive in Sonora and establish the Tepahui mission in the Yaqui Valley in the year 1627.

After some time, the jesuits began to commission the Yaquis to work in the mines for a pittance. Some mines were so far that it would have taken 2 months to walk there on foot.

There were many conflicts, and the Yaquis began to resist working in the mines which led to constant labor shortages.